In an age of digital advancement, personal finance management has become increasingly digitized, enabling individuals to take control of their financial lives like never before. UCU Personal Finance Manager stands at the forefront of this movement, offering a comprehensive and user-friendly solution. In this article, we explore the functionalities, versatility, and impact of UCU Personal Finance Manager on individual financial management.

A Holistic Approach to Financial Management:

UCU Personal Finance Manager is designed to cater to various aspects of personal finance, providing users with a complete toolkit to manage their money effectively. From day-to-day expense tracking to long-term financial goal planning, the platform offers an integrated experience.

Feature Highlights:

Expense Tracking and Categorization: Users can effortlessly track their expenses and categorize them for better understanding. This feature helps in identifying spending patterns and areas where adjustments can be made.

Budget Creation and Management: The platform facilitates the creation of customized budgets based on users’ financial goals and income. Budgets can be adjusted, tracked, and analyzed to ensure financial discipline.

Goal Setting and Progress Tracking: UCU Personal Finance Manager empowers users to set financial goals, such as saving for a vacation, buying a home, or paying off debt. Users can monitor their progress and stay motivated.

Bill Payment Reminders: Late bill payments can have a negative impact on one’s credit score and financial stability. The platform sends timely reminders to help users stay on top of their financial obligations.

Financial Insights and Reports: Users gain valuable insights into their financial behaviors through visual representations and reports. This helps in making informed decisions and strategizing for the future.

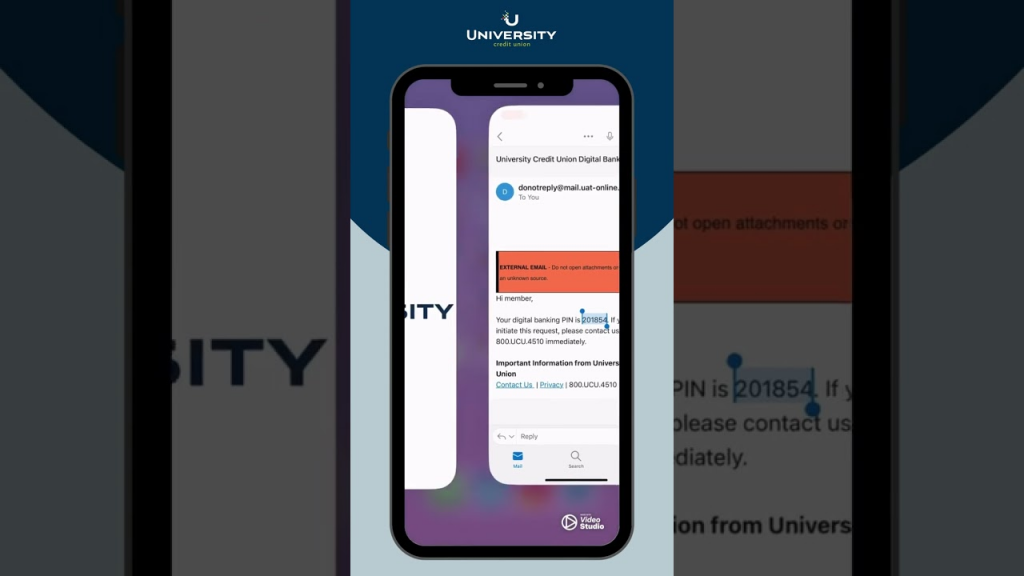

Secure Data Management: Data security is a priority, and UCU Personal Finance Manager ensures that users’ sensitive financial information is encrypted and protected.

The Versatility Advantage:

UCU Personal Finance Manager adapts to various financial scenarios, making it ucu personal finance manager for individuals at different life stages. Whether it’s students managing their college expenses, young professionals building savings, or families planning for retirement, the platform accommodates diverse needs.

Impact on Financial Habits:

By providing users with a comprehensive suite of tools and insights, UCU Personal Finance Manager encourages responsible financial behavior. It fosters better spending habits, informed decision-making, and the development of a financial roadmap.

Conclusion:

UCU Personal Finance Manager is more than just a financial tracking tool; it’s a companion on the journey toward financial stability and success. With its user-friendly interface, versatility, and focus on empowering individuals, the platform sets the stage for improved financial habits and long-term financial well-being.